Jafar’s Advises:

20 Question Technique to use when assessing a property investment.

Key questions to use when assessing a property investment. Key questions for buyers include:

- What is the cash flow of the property?

- What is the vacancy rate in the area?

- What is the competition?

- What improvements are being panned for in the area?

- What are council/government plans for the area?

- What’s the population growth like?

- Why do people live in this area?

- What’s the economy like in this area?

- What services are available (shops, schools, etc.)

- Is there transport nearby?

- Is the property tenant friendly?

- What condition is it in?

Choosing the Right Property

Where would you Buy? Focusing on an area:

- Is the area’s average income increasing faster than the provincial average?

- Is the area’s population growing faster than the provincial average?

- Is the area creating jobs faster than the provincial average?

- Does the area have more than one major employer?

- Is real estate in the surrounding regions booming?

- Will the property value benefit from a major new development nearby?

- Has the local and provincial political leadership created a growth atmosphere in the area?

- Is the region’s economic development office helpful and proactive?

- Is the area located in an area of renewal or gentrification?

- Is the major transportation improvement occurring nearby?

- Is the area attractive to Baby Boomers?

What would You BUY?

Buy – but not just anything

The more property we had, of course, the greater chance of cashing in on capital growth. But you need to be in a position to see out the wait for capital growth to kick in and that’s why you should only move for the right sort of property.

I think the current property market is exciting for investors but you need to proceed with some caution. Whatever you decide to buy, you have to feel confident that you can afford to keep it. Nothing is ever guaranteed and capital values certainly aren’t guaranteed. So if you’re banking on making a capital gain but are in a negative cash flow position with the property, you could be in strife.

If you lost your job or your business went bad the property doesn’t support itself, you could be in trouble. Whatever property you go into, you’ve got to make sure that it can be renovated to improve its value and equity also to improve its potential for rent.

You really need to achieve as high a yield as possible so you can hold it as possible and achieve the passive gains. For small investors at this time, yield needs to be a major factor in the decision to buy again.

We don’t know if prices are going to get much lower but personally think now is an incredibly good time to buy and I’d recommend that people go out and get their first property if they don’t have one already.

I have no doubt the market and it is definitely “buy” time.

Stick to the basics. They are reliable and a lot safer for the small or medium investor looking to expand the portfolio. Now is the time to buy property that you can get for low dollars and that has a constant demand. If people are forced out of the home ownership market, which some unfortunately will be, they have to live somewhere. So property at the lower end of the market is always in rental demand.

Focus on Opportunities not possible problems!

Proper use of upcoming opportunities is the key to success when we talk about investment.

The dictionary definition of an opportunity is ” a favorable time or occasion”. In a business and investing context it’s a new opening for profits.

I have seen many prospect investors who focus on the property itself instead of paying attention to the possible opportunity in purchasing process. Another words, there are buyers who concentrate on condition of plumbing, bathrooms or the roof while they may miss the opportunities which exist around the property.

Any problems you solve with your properties (replacing a furnace, upgrading bathrooms and renting a vacant unit) are important to keep them ticking over. But solving problems is different from seizing opportunities and it’s the latter that produces big gains.

Opportunities might include not limited to such things as:

- You get a new appraisal of your property higher than expected-this means more equity for new investment.

- You observe a temporary economic setback in specific area- a desirable area to purchase new investments in it.

- A rise in interest rates leads to more motivated sellers and property bargains.

- Distress sales, Fixer uppers and bargain properties are all true opportunities for investors.

- Government Grant Projects are other example of available opportunity in property investment.

IF BUYING A CONDO AS AN INVESTMENT:

Know the costs:

Make sure to calculate all your expenses, including down payment, legal fees, strata(condo) fees, property taxes, property transfer tax, home inspection fees, appraisal fees, painting, appliances and assessments to fix leaks or defects.

Know your ROI:

For a property that costs $ 250,000 and generates $ 1,300 per month in rent the cap rate is 6.24%(15,600 divided by $250,000). The rule tends to be that if you get less than an 8% cap rate, the property may not produce positive cash flow each month. That’ because if you have a $ 200,000 mortgage, at a rate of 6% amortized over 25 years, for example, your monthly payment will be $1,292.Then added condo fee, insurance and upkeep.

Know the laws:

get a copy of provincial condo legislation and by laws. Make sure rentals are allowed. Scrutinize strata council meeting minutes to see if there are recurring problems that could become your nightmare.

Know the deductions:

There are tax implications and deductions. Keep records such as receipts for extensions. Get professional advice from accountant and a lawyer.

Know the market:

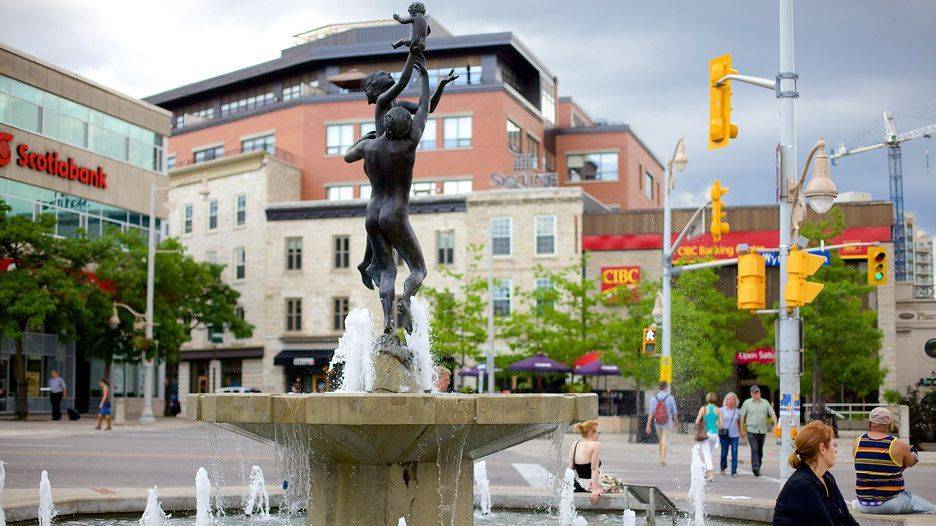

there will be dips and downturns in any area, but overall the trend line is usually up. Typically, the best location to get maximum price appreciation is in an area with good transportation and shopping close to downtown.

Know your limits:

Do you want to get up in the middle of the night to unclog a toilet? If not higher a manager.